What Our Debt Settlement Attorneys at The Wink Law Firm Can Do For You

If you have a higher income than most, or significant property (“non-exempt assets”), bankruptcy may not be your best choice.

Debt settlement can be a cost-effective alternative to bankruptcy when seeking debt relief. Where filing for bankruptcy may require you to pay back all or most of your debts, debt settlement becomes a cost-effective debt relief option which can enable you to get out of unsecured debt for less than is owed.

Schedule Your Free Debt Settlement Consultation Today

What is Debt Settlement?

Debt settlement is a form of debt relief that will entail you paying your creditors less than is owed to settle the balance in full. To achieve a reduction in the balance owed, you must be in default on the loan (i.e., not paying it when due). While ever you are paying the loan pursuant to its terms, your creditors have no incentive to accept less. However, when you stop paying the debt, you represent a collection risk and most unsecured creditors will eventually accept less than is owed to settle the balance in full.

How Can a Debt Settlement Attorney Help?

If you are thinking of pursuing debt settlement, let the Denver bankruptcy lawyers at The Wink Law Firm use our negotiating expertise to get you the very best settlement with your creditors. We have a lot of experience negotiating debt settlement and can advise you on how much to offer a creditor and when to accept a settlement offer. Creditors often want to know your hardship and financial circumstances when considering a settlement offer and the attorneys at The Wink Law Firm can help you respond to those inquiries. We can also help you consider your all your debt relief options including bankruptcy, the threat of which can be an effective negotiating tactic.

What Kind of Reduction is Possible?

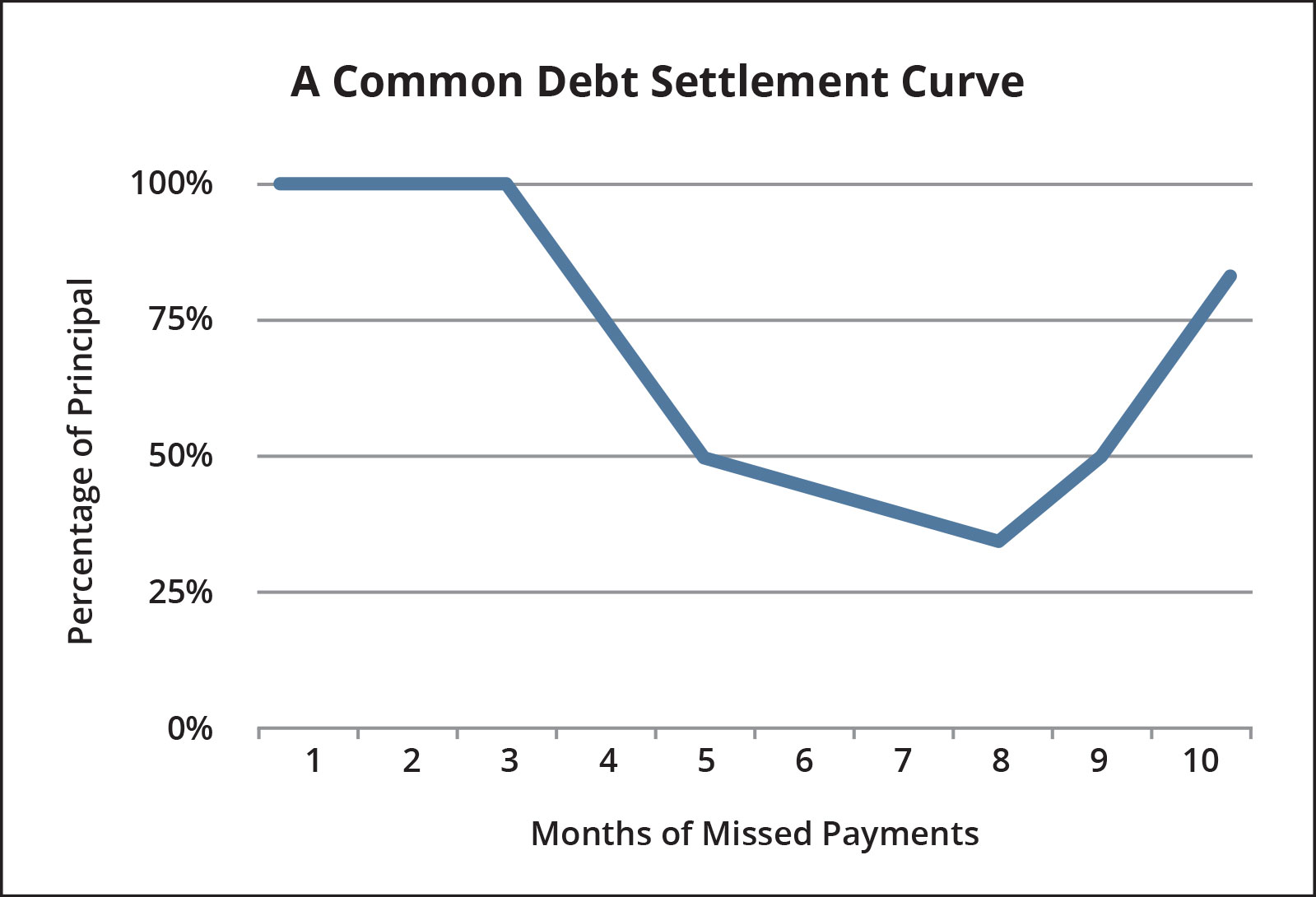

The amount required to settle an unsecured debt largely depends on the creditor, the amount of time you’ve been in default, and the terms of the settlement payment. Our experience tells us that credit card lenders will often accept approximately 50 percent of the amount owed to settle the debt in full. However, to achieve that, one should not be too far into default. This is because extended time in default increases the risk of a lawsuit. While you can typically settle a lawsuit for less than is owed, the amount required to settle a lawsuit tends to be higher (60%-80% of the balance due). The amount medical creditors will accept to settle a medical bill varies more than credit cards, but extremely favorable settlements can be achieved for certain medical bills.

Get to Know the The Wink Law Firm Team

The Wink Law Firm’s Expertise with High-Value Debt Settlements

When you choose The Wink Law Firm as your Denver bankruptcy lawyers, you get a complete package of legal services.

The Wink Law Firm will:

- Manage communications with your creditors

- Provide expert legal strategy if you get sued by a creditor

- Advise you to reject an offer that is not in your interest

- Advise you when to accept a highly-beneficial offer

- Never charge exorbitant fees for our services

Click to Begin Our Online Consultation Questionnaire